Is your trucking business bogged down by messy paperwork and confusing numbers? Imagine having all your financial information neatly organized, from fuel expenses to driver payroll. That’s the power of good accounting software for truckers.

Choosing the right accounting software can feel like navigating a maze. Many options exist, and not all are built for the unique needs of a trucking company. You might worry about tracking loads, managing invoices, and keeping up with tax deadlines. It’s easy to feel overwhelmed when you just want to focus on the road ahead.

This post will guide you through the best accounting software choices for your trucking business. We’ll break down what to look for and highlight features that can save you time and money. By the end, you’ll feel confident picking a tool that makes your financial life much easier.

Our Top 5 Accounting Software For Trucking Business Recommendations at a Glance

Top 5 Accounting Software For Trucking Business Detailed Reviews

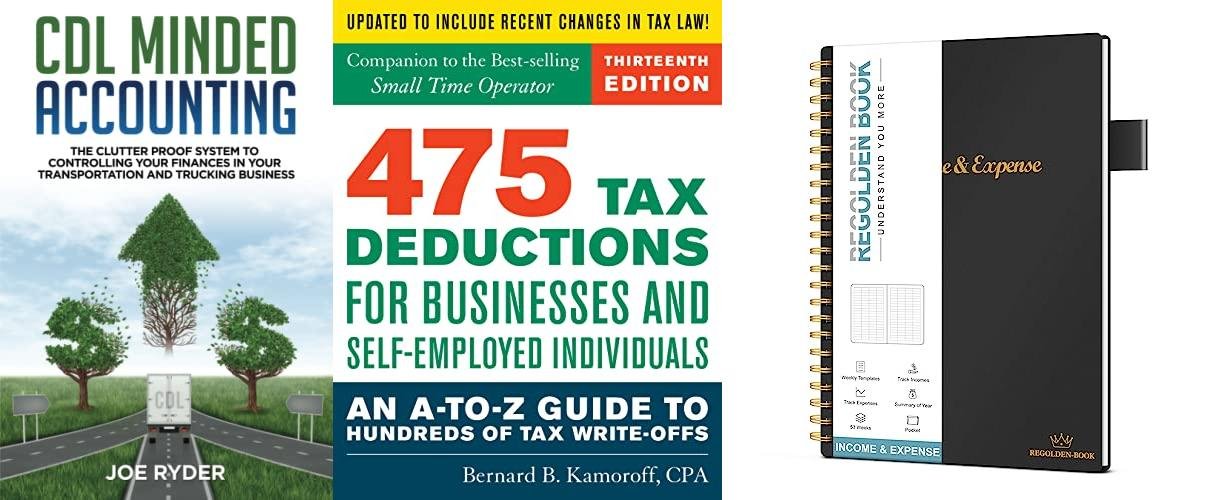

1. CDL Minded Accounting: The Clutter Proof System to Controlling your Finances in your Transportation and Trucking Business

Rating: 9.5/10

Are you a truck driver or run a trucking business and feel like your money matters are a big mess? CDL Minded Accounting: The Clutter Proof System to Controlling your Finances in your Transportation and Trucking Business is here to help. This system is designed to make managing your money simple and organized. It helps you keep track of all your income and expenses, so you always know where your business stands financially. No more piles of receipts or confusing spreadsheets!

What We Like:

- Helps you organize all your business money.

- Makes it easy to see if you are making or losing money.

- Reduces stress about finances.

- Designed specifically for trucking businesses.

What Could Be Improved:

- Could include more step-by-step video tutorials for beginners.

- A mobile app version would make it easier to use on the go.

- More integration options with other trucking software might be helpful.

This system aims to bring peace of mind to your business finances. Give it a try and see how much easier managing your money can be.

2. 475 Tax Deductions for Businesses and Self-Employed Individuals 13th Ed

Rating: 8.9/10

Navigating the world of taxes can be tricky, especially for business owners and self-employed folks. The “475 Tax Deductions for Businesses and Self-Employed Individuals 13th Ed” aims to make this process easier. This book is a guide that helps you find all the ways you can save money on your taxes. It lists a lot of different deductions. This can help you keep more of your hard-earned money.

What We Like:

- The book offers a huge number of potential tax deductions, which is its main strength.

- It breaks down complex tax rules into understandable terms.

- It covers a wide range of business types and self-employment situations.

- Having this information in one place saves a lot of searching.

- Staying updated with the 13th edition means it likely includes recent tax law changes.

What Could Be Improved:

- The sheer volume of deductions can be overwhelming for some users.

- It might be helpful to have more real-life examples or case studies.

- A digital version or online searchable database would be a modern addition.

- Some sections could be simplified further for absolute beginners.

This book is a valuable resource for anyone looking to reduce their tax burden. It empowers you with knowledge to find every possible deduction.

3. Income & Expense Tracker

Rating: 9.2/10

Take control of your business finances with this Income & Expense Tracker, Accounting Bookkeeping Ledger Book. It’s designed to make managing your money simple and efficient, helping you understand where your income comes from and where your money goes. This book is a great tool for any small business owner.

What We Like:

- This book makes tracking income and expenses super easy. You can record daily, weekly, and monthly details.

- It helps you organize your money and understand your financial situation better.

- The book is made with good quality materials. It has a strong cover and a double binding so it lasts.

- It includes a handy inner pocket for receipts and a pen loop to keep your pen safe.

- The classic black design looks professional and it’s not too big, making it easy to carry.

- You can see your whole year’s financial summary, which is great for looking back and planning.

- The size (8.5×6 inches) is just right for keeping records at work or home.

- It’s a thoughtful gift for anyone who needs to manage money.

- The company offers good customer service if you have questions.

What Could Be Improved:

- While the size is good, some users might prefer a slightly larger page for more detailed notes.

- The “53 Weeks” feature is great for a full year, but it doesn’t explicitly state if it covers exactly 52 weeks plus a little extra or if there’s a specific way to handle the 53rd week if a year has 53 full weeks.

This ledger book is a practical tool for keeping your business finances in order. It offers a straightforward way to manage your money and gain insights into your business’s financial health.

4. The Farmer’s Office

Rating: 8.5/10

Starting a farm can feel like a huge undertaking. You need to know about planting, harvesting, selling, and so much more. This book, “The Farmer’s Office, Second Edition: Tools, Templates, and Skills for Starting, Managing, and Growing a Successful Farm Business,” is designed to help you with all of that. It’s like having a whole team of experts in one place, ready to guide you through every step of building a thriving farm business.

What We Like:

- It offers practical tools and templates that make planning and managing your farm much easier.

- The book covers a wide range of topics, from the very beginning of starting a farm to growing it bigger.

- It gives you the essential skills you need to be successful in the farming business.

- The content is easy to understand, even if you’re new to farming.

What Could Be Improved:

- While it’s a great resource, some users might want even more in-depth case studies of different types of farms.

- The digital versions of the templates could be more easily integrated with common business software.

This book equips you with the knowledge and resources to confidently run your farm. It’s a valuable guide for anyone dreaming of a successful agricultural venture.

5. Accounting II Guide – Business Accounting Quick Reference Guide by Permacharts

Rating: 9.1/10

The Accounting II Guide – Business Accounting Quick Reference Guide by Permacharts is a handy tool for anyone wanting to understand business accounting better. It’s a 4-page laminated guide that builds on basic accounting knowledge. This guide helps you dive deeper into how businesses handle their money.

What We Like:

- It helps you learn more about accounting after you know the basics.

- It clearly explains balance sheets and how assets are handled.

- You get definitions for different types of assets and see how they are used.

- The guide includes a helpful glossary of accounting terms.

- It’s great for small businesses, managing personal money, and students.

- The laminated pages make it durable and easy to use again and again.

What Could Be Improved:

- While it’s a quick reference, some topics might need more detailed explanation for absolute beginners.

- The schematic format for asset treatment, while helpful, could be expanded with more examples.

This guide is an excellent resource for quickly reviewing important Accounting II concepts. It offers a solid foundation for understanding business assets and financial terms.

Choosing the Right Accounting Software for Your Trucking Business

Running a trucking business means juggling a lot of things. You have to manage your fleet, find good loads, and keep your drivers happy. But don’t forget about your finances! Good accounting software makes managing your money much easier. This guide will help you pick the best software for your trucking company.

Key Features to Look For

When you’re picking accounting software, think about what your business needs most.

- Fuel Tracking: This is super important for truckers. The software should let you easily record and track all your fuel expenses.

- Expense Management: You’ll have many expenses besides fuel, like maintenance, tolls, and insurance. The software should make it simple to log these.

- Invoicing and Billing: Getting paid on time is crucial. Look for software that creates professional invoices and helps you track payments.

- Load Management: Some software can help you track your loads, calculate revenue per load, and see which routes are most profitable.

- Mileage Tracking: Knowing your mileage is vital for tax purposes and for calculating driver pay.

- Reporting: You need reports to understand your business’s financial health. Look for software that offers clear reports on income, expenses, and profit.

- Integration: Does the software work with other tools you use, like GPS or ELD systems? This can save you a lot of time.

Important Materials (What to Consider)

While there aren’t physical “materials” for software, think about these important aspects:

- Cloud-Based vs. Desktop: Cloud-based software lets you access your finances from anywhere with internet. Desktop software is installed on your computer. Cloud is usually more flexible.

- Scalability: Can the software grow with your business? If you plan to add more trucks, make sure the software can handle it.

- Security: Your financial data is sensitive. Ensure the software has strong security measures to protect your information.

Factors That Improve or Reduce Quality

Several things make accounting software better or worse for your trucking business.

Factors That Improve Quality:

- Ease of Use: If the software is hard to figure out, you won’t use it effectively. A simple, intuitive design is best.

- Customization: Can you adjust reports or add specific fields to match your trucking business needs?

- Customer Support: When you have a question or problem, good customer support is a lifesaver. Look for responsive and helpful support teams.

- Regular Updates: Software companies should update their programs to fix bugs and add new features.

Factors That Reduce Quality:

- Complicated Interface: A confusing layout wastes your time and can lead to mistakes.

- Lack of Trucking-Specific Features: Generic accounting software might not have the special tools truckers need.

- Poor Customer Service: If you can’t get help when you need it, the software can become a source of frustration.

- Bugs and Glitches: Software that crashes or has errors is unreliable.

User Experience and Use Cases

Good accounting software should feel like a helpful tool, not a chore.

User Experience:

The best software has a clean look and is easy to navigate. You should be able to find what you need quickly. Entering data should be fast. Reports should be easy to read and understand.

Use Cases:

- Small Owner-Operators: A simple, affordable option that handles fuel, expenses, and invoicing.

- Medium-Sized Fleets: Software that offers more advanced load tracking, driver pay calculations, and detailed reporting.

- Larger Companies: Solutions that can integrate with other business systems, offer payroll, and provide deep financial analysis.

Frequently Asked Questions (FAQ)

Q: What are the main Key Features a trucking business should look for in accounting software?

A: Key features include fuel tracking, expense management, invoicing, mileage tracking, and good reporting capabilities. Load management and integration with other systems are also very helpful.

Q: Is cloud-based accounting software better for truckers?

A: Cloud-based software is often better because you can access your financial information from any device with internet, which is useful when you’re on the road.

Q: How important is it for the software to have specific trucking features?

A: It’s very important. Features like fuel tracking and mileage logs are designed for the trucking industry and save you a lot of time and effort.

Q: What if I’m not good with computers? Is there easy-to-use software?

A: Yes, many software options focus on a simple and intuitive user experience. Look for reviews that mention ease of use.

Q: Can accounting software help me track my profits per load?

A: Many trucking-specific accounting software programs can help you track revenue and expenses for each load, showing you which loads are most profitable.

Q: How does mileage tracking help my business?

A: Mileage tracking is important for tax deductions and for calculating your business’s operating costs accurately.

Q: What should I do if I have a problem with the software?

A: Look for software that offers good customer support. This means they have helpful guides, email support, or phone support.

Q: Can accounting software help me manage my drivers’ pay?

A: Some advanced trucking accounting software can help calculate driver pay based on mileage, loads, or other factors.

Q: Do I need to pay for accounting software?

A: Most good accounting software has a monthly or annual subscription fee. Some free options exist, but they often lack important features for businesses.

Q: How can I be sure the software is secure?

A: Reputable software providers use strong encryption and security measures to protect your financial data. Check their security policies.

In conclusion, every product has unique features and benefits. We hope this review helps you decide if it meets your needs. An informed choice ensures the best experience.

If you have any questions or feedback, please share them in the comments. Your input helps everyone. Thank you for reading.